What's working for YC companies since the AI boom

The goal of this analysis was to understand what’s working for YC companies by looking at which ones have raised Series A rounds.

I was really excited to take a look at the data for a number of reasons:

We finally have 2 years of batch data since ChatGPT started the AI boom, which gives us some meat to analyze.

YC is always interesting to dig into since it still has the cachet to attract top talent, and the batches are big enough to have a real population of companies that are representative of the market.

Demo day is coming up, and we’ve been tracking the latest batch.

First Round just announced Series A rounds for Reducto and David AI, and they have such an impressive hit rate - so I got curious whether there are actually tons of YC Series A rounds happening, or if First Round just crushes it (turns out they just crush it).

Before diving into the findings, I’ll say the data is skewed and has a lot of limitations. For example, companies that raised large initial rounds (like Worldware's $30M from Spark) aren't going back to market anytime soon. We’re only seeing what gets announced on Crunchbase. I am only looking at the four batches directly after ChatGPT launched. The goal here is a quick snapshot of “what's working” since the market is moving so quickly, rather than a full breakdown of all YC batches or getting any answer to the question, “Does the YC model still work?”

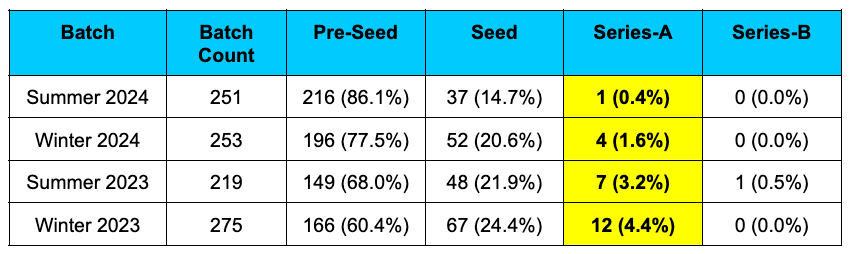

Final caveat - the topline number is: out of 998 companies from the first four batches since ChatGPT launched (Winter 2023, Summer 2023, Winter 2024, Summer 2024), only 24 have raised Series A rounds - just 2.4%.

But this isn’t a great number to lean into as a takeaway. Most of these companies haven't had enough time to mature, since the typical Seed-to-Series A timeline is around 18 months, and only the Winter 2023 batch fits that window.

So please take this post as surfacing directional trends rather than definitive statements.

Ok! Let’s get into it. Here is what I found looking at Series A data since the Winter 2023 batch —

Key Takeaways

Key takeaways from the 24 Series A companies include:

Business automation and operational tooling dominance. Probably the most surprising part of this analysis was how many of the winners were in internal business automation and operational platforms. The data looked different than the “what’s working in AI” analysis I did last year, which looked at Series A AI companies more broadly. There was less diversity here. This suggests the two obvious things:

Network advantages. The batches provide a built-in customer base for B2B operations and automation that can drive success (e.g, Deel, Brex). I don’t know who the customers are for the successful companies in this category, but I’m curious how many of them were accelerated by the YC batch advantage.

Technical talent. YC’s founder tends to be young, technical, and good at executing, which is an archetype that naturally gravitates towards automation infrastructure, developer tools, and general optimizations, perhaps rather than heavy vertically embedded software.

“AI for X” verticals are surprisingly narrow. Despite the hype around “AI for X” (e.g. AI for dentists), the only vertical AI categories that made it into the data are legal and patent-focused (e.g. Legora, Solve).

Platform/API-first success. 50% of successful companies are explicitly building platforms or APIs. This suggests YC’s breakout companies do lean into developer adoption and network effects for success and growth, and successful companies are not building one-off products.

There are notable absences from Series A success:

Zero LLM evaluation, observability, or tooling companies in the Series-A data.

Zero consumer, hardware, or deep tech companies in the Series-A data.

Top-tier lead investors matter. Most of the Seed rounds include top-tier lead investors — First Round Capital, General Catalyst, Uncork, Crat, Index, Soma, Greylock, Benchmark. Obviously, if one of these funds gives you a term sheet, it’s a no-brainer. However, we see party rounds at $2m on $20m (or $2m on $30m) with $200K left all the time pre-demo day, and this data suggests that having a reputable fund as a lead can be a better long-term setup for success.

Interactive Market Map

Along with this analysis, I built a simple website to interact with the companies and get a better visual of the categories.

Check it out here:

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥

https://yc-market-map-dot-chapter-one-340115.uc.r.appspot.com/

🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥 🔥

Quick Topline

As mentioned above, the batches haven’t had much time to mature. Here is a table with the topline raise metrics:

Follow-Up Questions & Analysis Opportunities

It’s worth mentioning that this data opened up a ton of questions that I’d love a chance to explore in the future:

How do these trends compare to the broader Seed-to-Series A market?

How much more likely is B2B SaaS to raise Series A versus other categories within YC?

As YC valuations have increased and terms have become less investor-friendly, are companies from recent batches struggling more with Series A fundraising compared to earlier batches? Or is the strategy working and aligned with the broader market?

Are there any patterns in founders’ backgrounds?

Company Breakdown by Category

Now, here are all the companies in the data broken down by category —

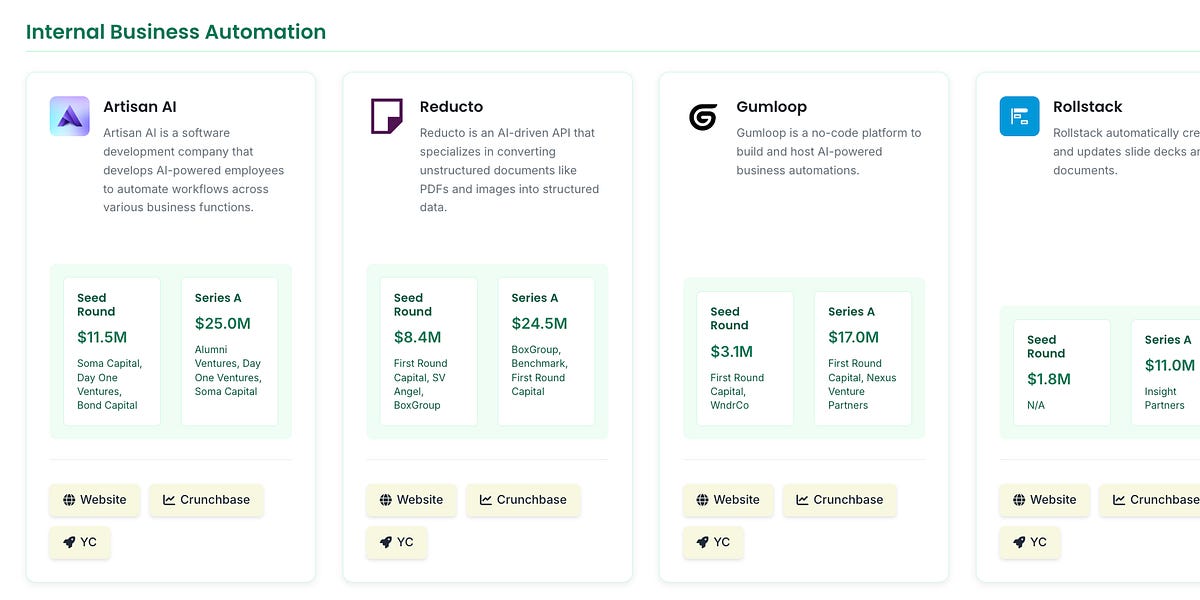

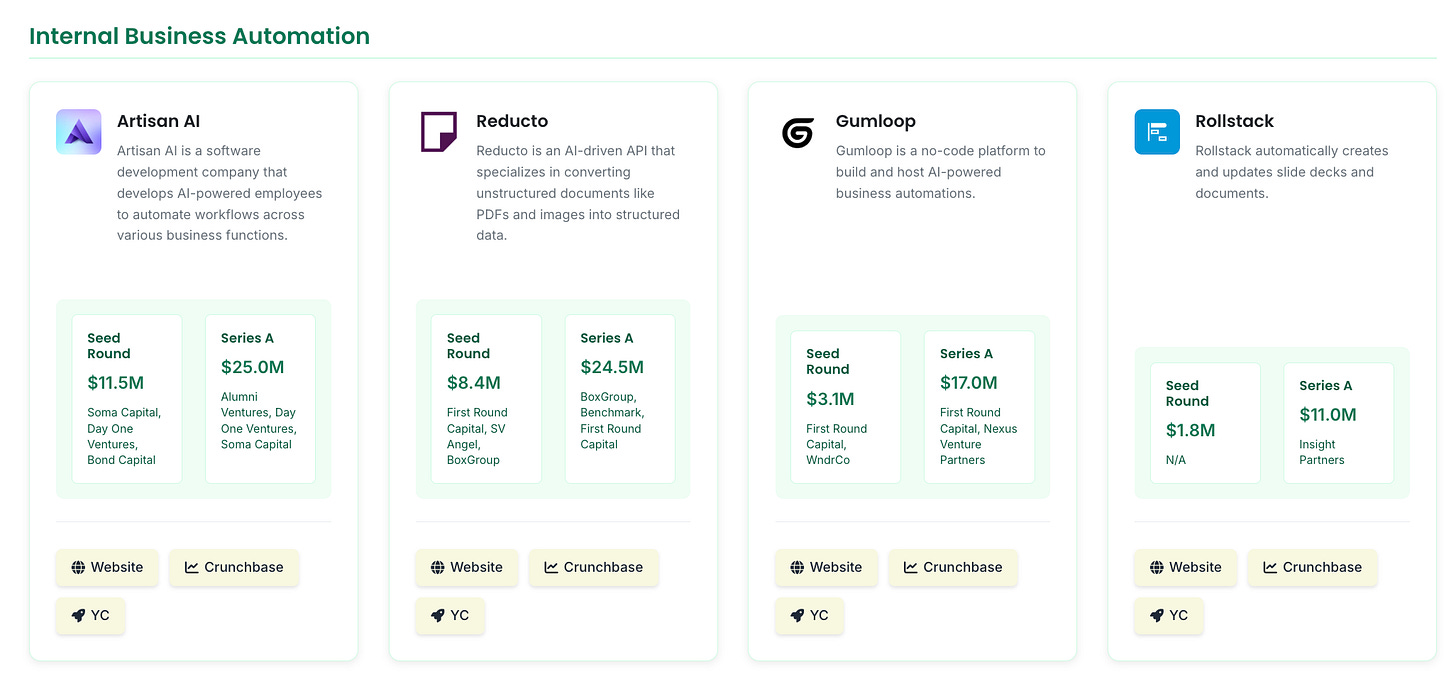

Internal Business Automation

Companies enabling businesses to optimize processes and build internal applications.

Artisan - Artisan automates your outbound with an all-in-one, AI-first platform powered by AI employees.

Reducto - Reducto is an AI-driven API that specializes in converting unstructured documents like PDFs and images into structured data.

Gumloop - Gumloop is a no-code platform to build and host AI-powered business automation.

Rollstack - Rollstack automatically creates and updates slide decks and documents.

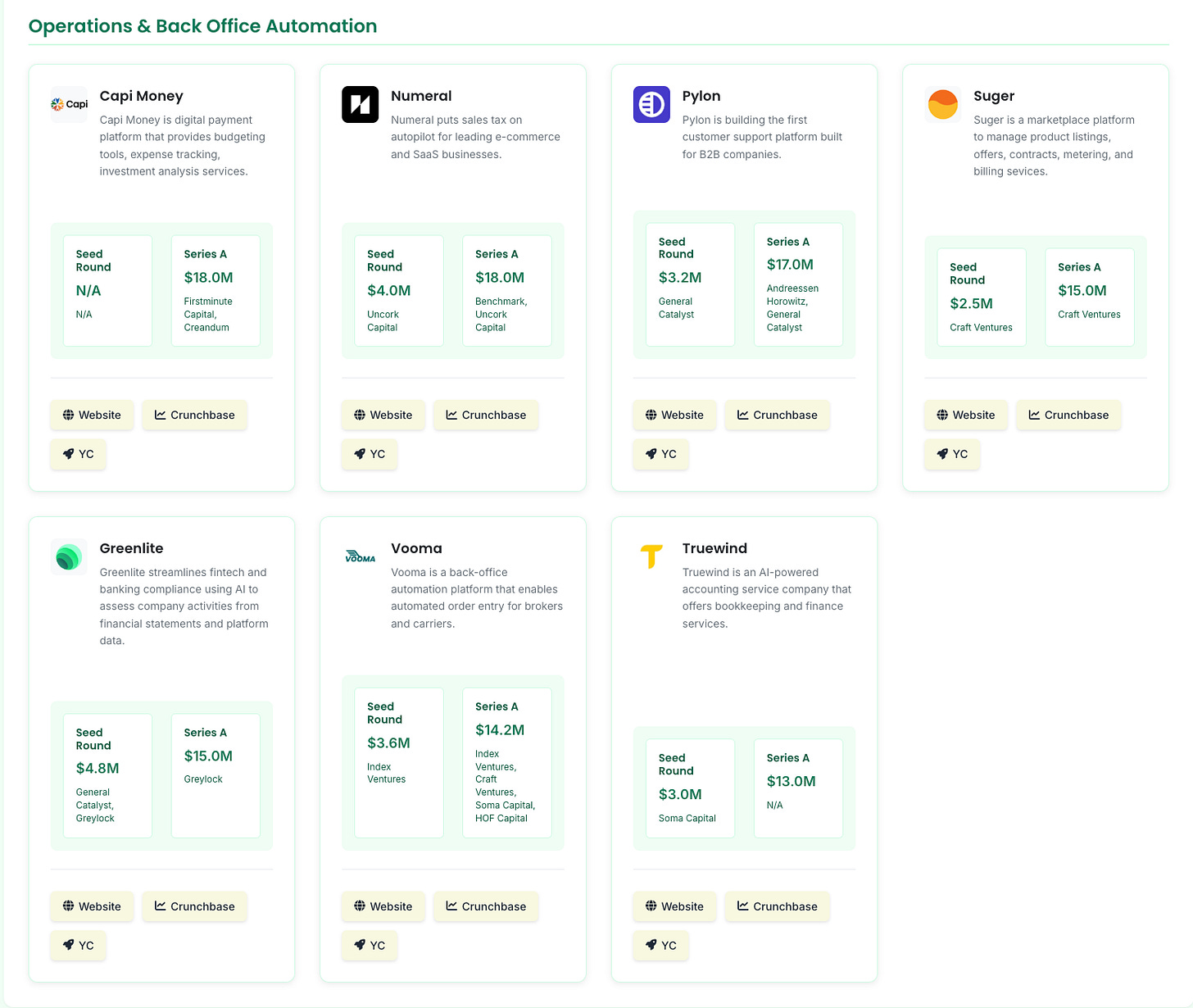

Operations & Back Office Automation

Platforms and integrations for back office operations (billing, taxes, accounting, contracts).

Capi Money - Capi Money is digital payment platform that provides budgeting tools, expense tracking, investment analysis services.

Numeral - Numeral puts sales tax on autopilot for leading e-commerce and SaaS businesses.

Pylon - Pylon is building the first customer support platform built for B2B companies.

Suger - Suger is a marketplace platform to manage product listings, offers, contracts, metering, and billing sevices.

Greenlite - Greenlite streamlines fintech and banking compliance using AI to assess company activities from financial statements and platform data.

Vooma - Vooma is a back-office automation platform that enables automated order entry for brokers and carriers.

Truewind - Truewind is an AI-powered accounting service company that offers bookkeeping and finance services.

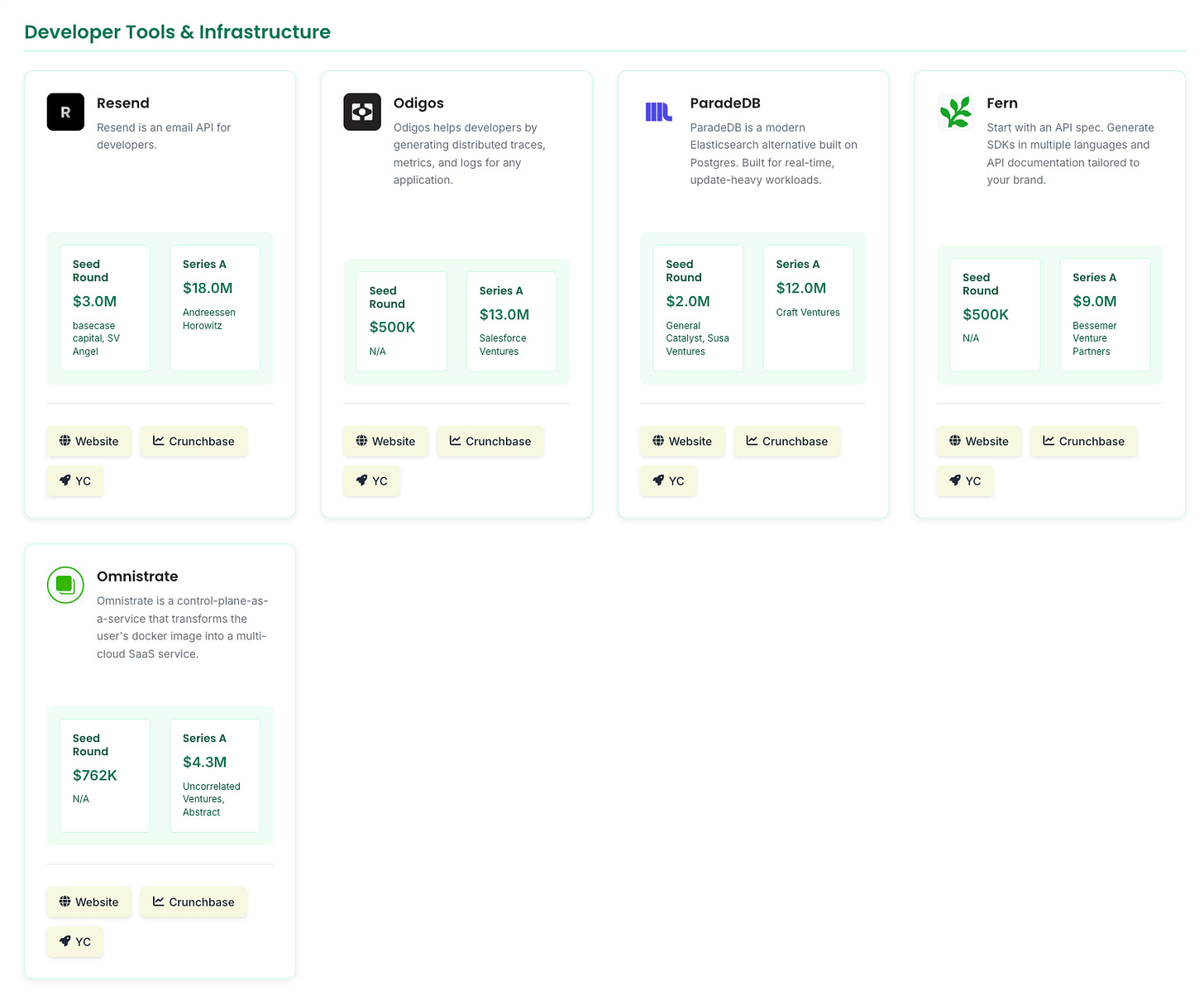

Developer Tools & Infrastructure

Tools enabling developer teams to focus on core products rather than building infrastructure.

Resend - Resend is an email API for developers.

Odigos - Odigos helps developers by generating distributed traces, metrics, and logs for any application.

ParadeDB - ParadeDB is a modern Elasticsearch alternative built on Postgres. Built for real-time, update-heavy workloads.

Fern - Start with an API spec. Generate SDKs in multiple languages and API documentation tailored to your brand.

Omnistrate - Omnistrate is a control-plane-as-a-service that transforms the user's docker image into a multi-cloud SaaS service.

Vertical AI Solutions

AI applications for specific industries.

Legora - Legora is a collaborative AI that empowers lawyers by enabling them to review documents, conduct research, and draft legal materials.

Solve Intelligence - Solve Intelligence is an artifical intelligence company that offers generative AI technology for writing patents.

Voice AI

Audio and voice automation platforms.

David AI - The data layer for audio AI.

Bland AI - Bland AI provides a platform for realistic AI phone call automation..

Happy Robot - HappyRobot is a voice AI tool that automates phone operations used in the the logistics and fleet management sectors.

Foundational & Miscellaneous Category

Flower Labs - Flower is a federated learning, analytics, and evaluation platform.

Persist AI - Persist AI is a biotechnology company that builds long-acting microsphere formulations.

Craftwork - Craftwork is a home service company that provides interior and exterior painting works.

Outro

Thanks for reading! This was quick and high-level, but hopefully you found it interesting and useful. For any YC founders in this batch, good luck with Demo Day and the raise!

Thanks for reading Jamesin’s Substack! Subscribe for free to receive new posts.

I’m a General Partner at Chapter One, an early-stage venture fund that invests $500K - $2M checks into pre-seed and seed-stage startups.

If you’re a founder building a company, please feel free to reach out on Twitter (@seidtweets) or Linkedin (https://www.linkedin.com/in/jamesin-seidel-5325b147/).

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0