Trump Media Raises Money to Buy $2.5 Billion in Bitcoin

Trump Media & Technology Group, the parent company of Truth Social, said on Tuesday that it would raise $2.5 billion from institutional investors to invest in Bitcoin, continuing its transformation from a social media company into a financial services and crypto play.

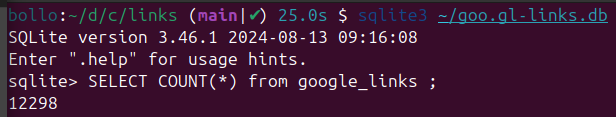

Trump Media, whose largest shareholder is President Trump, said it would raise $1.5 billion from about 50 institutional investors by selling roughly 58 million shares. The company is planning to raise an additional $1 billion from the sale of bonds that can also be converted into shares at a later date.

The announcement came as the president and his family have become more involved in a number of crypto companies. Mr. Trump owns a little over 50 percent of Trump Media’s stock, making his roughly $2.7 billion stake one of his most valuable investments.

The sale of the new shares will potentially dilute the value of Trump Media’s stock, including the 115 million shares that Mr. Trump owns. The president’s shares are held in a trust managed by his eldest son, Donald Jr., who also is a Trump Media board member.

As part of the deal, which could close as soon as Thursday, the shares will be sold at $25.72.

Shares of Trump Media were down 9 percent in afternoon trading on Tuesday. The stock is down 31 percent for the year.

Trump Media, which has a market value of just over $5 billion, said that with the cash raised from the stock and bond sale it would create one of the largest corporate reserves to invest in Bitcoin. The company is taking a page from the investment strategy made famous by Michael Saylor’s company Strategy, formerly known as MicroStrategy, which was one of the first to invest mightily in Bitcoin as a cash-management technique.

“We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets,” Devin Nunes, the company’s chief executive officer and a former California congressman, said in a statement.

The company did not immediately disclose the investors in the deal.

Trump Media went public a little over a year ago, after completing a merger with a cash-rich shell company. But the company has been losing money ever since, and Truth Social has generated just a few million dollars in advertising revenue, even as the social media platform serves as Mr. Trump’s primary online megaphone for communicating to the public.

Last quarter, Trump Media recorded a $32 million loss on just $820,000 in revenue from advertising and other sources.

Mike Stegemoller, a professor of finance at Baylor University, said Trump Media appeared to be “throwing in the towel” on its original business strategy. He added, “This does not look like a high-growth social media platform.”

This year, the company began to move away from its reliance on advertising dollars and into crypto and financial services.

Last month, Trump media announced a deal with Crypto.com and an affiliate of Yorkville Advisors, a New Jersey investment firm, to launch a series of exchange-traded funds by the end of the year. The series of E.T.F.s will invest in Bitcoin and so-called America First businesses that are in keeping with President Trump’s campaign pledges.

The company also said it planned to invest in Bitcoin as part of its corporate cash management strategy, but Tuesday’s announcement moved Trump Media into that strategy in a much bigger way.

Bitcoin is trading near an all-time high and is up more than 50 percent over the past year.

Both Crypto.com, which is based in Singapore, and Yorkville also will play a role in Trump Media’s new Bitcoin investment strategy, as well as the crypto bank Anchorage Digital.

Trump Media also retained Cantor Fitzgerald as its financial adviser. Cantor is the company formerly led by Commerce Secretary Howard Lutnick and has begun to also embrace crypto as an investing strategy.

Initially a crypto critic, Mr. Trump went on to fully champion the industry during last year’s presidential campaign and vowed that his administration would take a more welcoming approach to digital assets than the Biden administration did.

Shortly after Mr. Trump returned to office, securities regulators dismissed roughly a dozen lawsuits against and pending investigations of crypto companies. In March, Crypto.com said it had been notified that an investigation into the platform’s activities had been closed.

Mr. Trump is estimated to have added billions of dollars to his personal fortune, at least on paper, since the start of his new term, much of it through crypto.

Last week, the president hosted a dinner at his Virginia golf club, and among the guests were the highest-paying customers of his personal cryptocurrency, known as $TRUMP. The event helped promote sales of the memecoin, which was introduced just days before Mr. Trump’s inauguration and has become a vehicle for investors, including many foreigners, to funnel money to his family.

World Liberty Financial, a crypto venture largely owned by a Trump family corporate entity, recently pulled in $2 billion from the government of the United Arab Emirates. American Bitcoin, a crypto firm co-founded by Eric Trump, another of the president’s sons, said this month that it planned to go public, another expansion of the Trump family’s investments across the crypto industry.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0