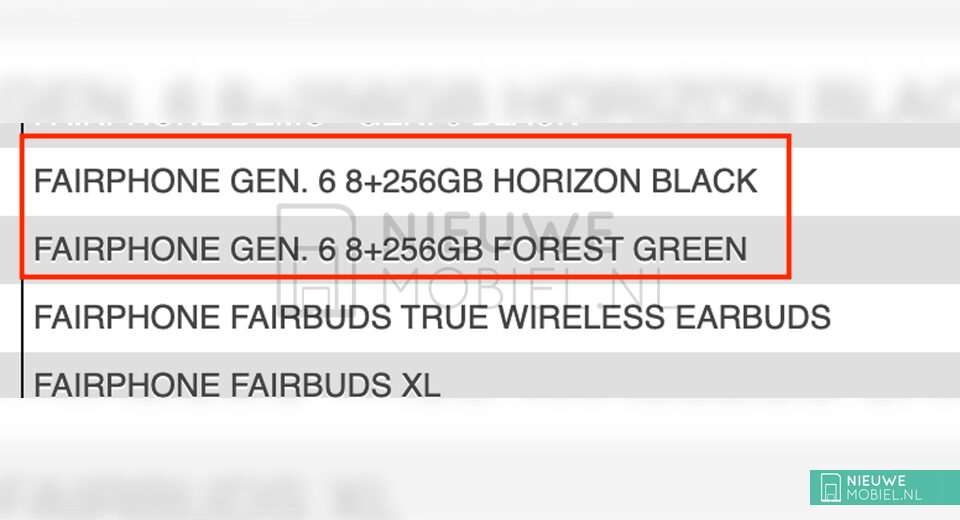

BlackRock eyes 10% stake in Circle's IPO — Report

Asset managers BlackRock and ARK Invest have indicated interest in acquiring over $150 million in Circle’s shares

BlackRock is reportedly planning to take a significant stake in Circle’s upcoming initial public offering (IPO).

According to a May 28 Bloomberg report citing anonymous sources, BlackRock is looking to purchase roughly 10% of the offering. Circle, the issuer of the USDC stablecoin, is aiming to raise $624 million in its initial public offering

Cathie Wood’s Ark Investment Management is also interested in buying $150 million worth of shares in the offering, the report said.

Circle launched its offering of 24 million shares of Class A common stock on May 27. The offering consists of shares from the company as well as shares of existing stakeholders, including co-founder and CEO Jeremy Allaire. According to the report, Circle’s IPO has now received orders for multiple times the shares available.

The company filed for an initial public offering on April 1, but delayed plans citing economic uncertainty. Crypto firms Ripple and Coinbase were reportedly exploring a potential acquisition of Circle. The company has since dismissed the speculation, saying it “is not for sale.”

Related: Circle co-founder to create ‘AI-native’ bank after $18M raise

USDC market share

With a market capitalization of $60.9 billion as of May 28, Circle’s USDC (USDC) represents 24.6% of the stablecoin market, only behind Tether’s USDt (USDT).

According to its Form S-1 registration statement, Circle had $1.67 billion in revenue in 2024, representing a 16% increase year-over-year. However, its net income fell from $267.6 million in 2023 to $155.7 million in 2024, a 41.8% decline.

Circle’s main competitor, Tether, is seemingly not interested in pursuing an IPO. In an X post on April 4, Tether CEO Paolo Ardoino said that “Tether doesn’t need to go public.”

Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0