Bitcoin to test $110K as macro analysis tells traders to 'buckle up'

Bitcoin price performance frustrates bulls as $110,000 stays out of reach, but the clock is ticking to even more risk-asset volatility.

Key points:

Bitcoin tries and fails to crack $110,000 as overhead liquidity thickens.

Traders say that more signs of strength are needed to reignite bull market momentum.

Macro cues include next week’s CPI print as a potential volatility date.

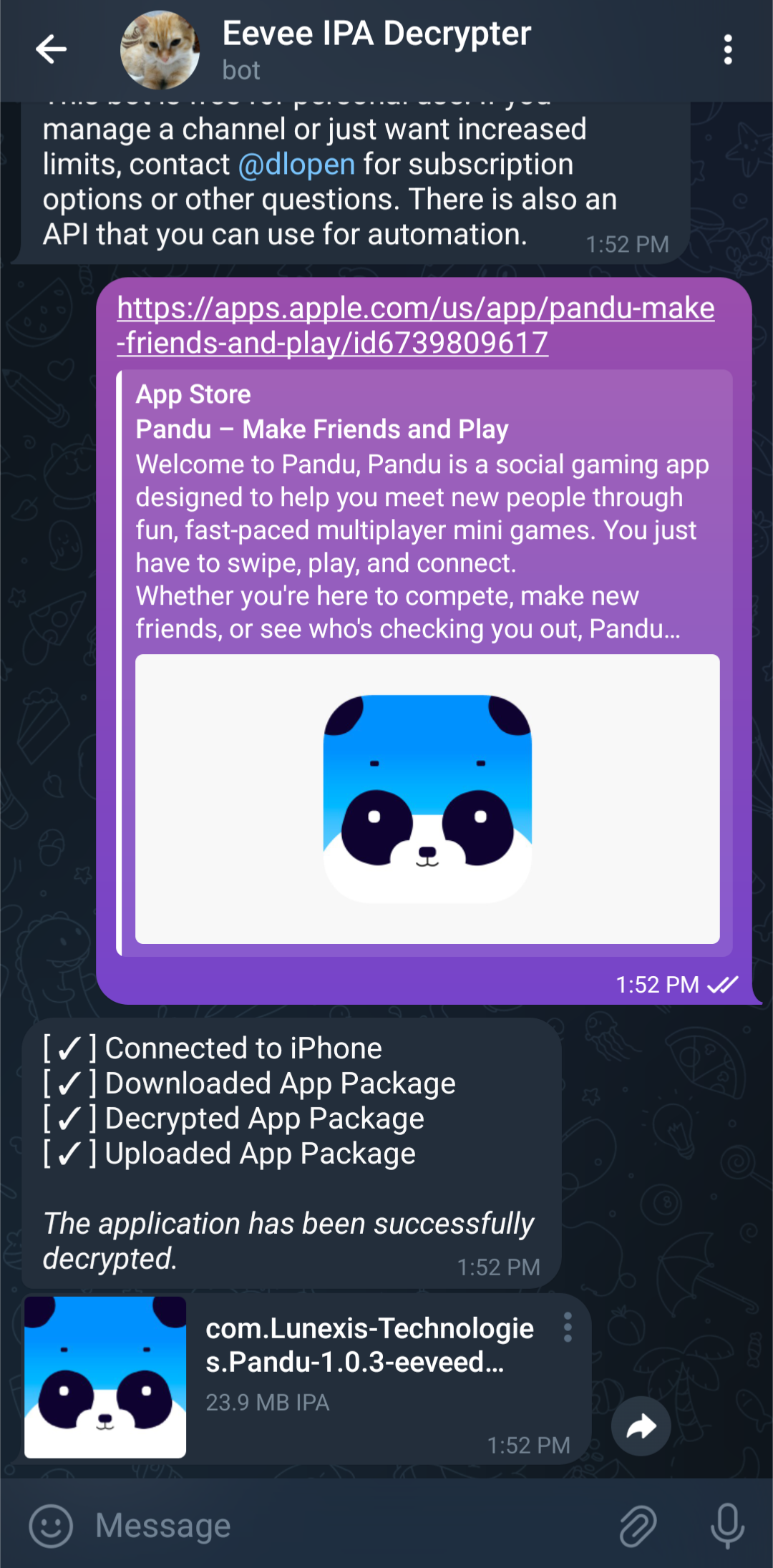

Bitcoin (BTC) attempted a run on $110,000 around the July 9 Wall Street open as sellers lined up to keep the price in place.

Bitcoin bulls stumble before reaching $110,000

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching $109,777 on Bitstamp before reversing.

Still wedged in a narrow range, the pair was contained by exchange order-book liquidity, which strengthened around the move.

Data from monitoring resource CoinGlass showed bid and ask liquidity strongest at around $108,500 and $110,500, respectively.

Reacting, crypto market participants hoped that the stage was being set for a long-anticipated assault on all-time highs.

“Almost all liquidity is to the upside. Stops above $110k are not safe,” popular trader Jelle wrote in part of an X post on the topic.

Jelle predicted a trip to $130,000 should bulls succeed in cracking the $110,000 mark, which had not seen a daily close since June 11.

#Bitcoin broke the bullish flag, retested it, and now pushes higher.

Clear $110k, and $130k is the next target.

You ready? pic.twitter.com/akSRfxoP6v— Jelle (@CryptoJelleNL) July 9, 2025

Continuing, fellow trader BitBull flagged relative strength index (RSI) data as key to determining Bitcoin’s potential next move.

“3D RSI and price are both forming an inverse head and shoulder pattern,” he told X followers, referring to a classic bullish chart feature.

“For breakout, we need one of these 2 things. Either a 3D close above $110K or a 3D RSI close above 70. After that, we'll experience an up-only rally for 3-4 weeks.”

“Stage is set” for crypto, risk-asset volatility

With the US trade-tariff debacle still unfolding, macro analysis turned to upcoming volatility triggers for crypto and risk assets.

Related: Bitcoin Mayer Multiple shows $108K BTC price undervalued: Analysis

In its latest bulletin to Telegram channel subscribers on the day, trading firm QCP Capital highlighted next week’s Consumer Price Index (CPI) print as part of the ongoing US inflation story.

This, it argued, would weigh on market expectations for Federal Reserve interest-rate cuts, potentially altering sentiment in the process.

“Last week’s hot jobs data dampened rate cut optimism,” the bulletin observed.

“Markets have scaled back expectations to two cuts in 2025, down from 2.5 previously. A July cut is all but priced out. September odds have slipped from 90% to 70%.”

QCP described Bitcoin as “well bid,” noting US dollar weakness and consistent institutional inflows despite the precarious macro picture.

“With a reignited trade war, a more hawkish Fed, and tightening liquidity conditions, the stage is set for elevated volatility,” it concluded.

“Macro catalysts are lining up. Buckle up.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0