Advertising Without Signal: The Rise of the Grifter Equilibrium

Advertising Without Signal: The Rise of the Grifter Equilibrium

Economists credit ads with two welfare‑enhancing roles:

- Informative – trimming search costs (Stigler 1961 (pdf)).

- Signaling – In classic models, high-quality sellers are more willing to incur large, sunk ad costs because they expect to recoup them through future sales—especially in experience-good markets where quality is learned over time (Nelson 1974). Milgrom and Roberts (1986) formalize this idea: when ad spend is costly and more valuable to better firms, it can serve as a credible signal of quality.

Internet upended the first role—search is instant—but also weakened the second.

Five Frictions That Flatten the Signal

- Disposable brand identities

- Launching a fresh storefront requires packaging, photography, and a seed set of paid or incentivized reviews; yet, those outlays are tiny relative to the lifetime margin on a successful listing. Because tarnished names can be retired cheaply, long‑run reputation no longer disciplines bad actors.

- CPA pricing removes the burn

- Most major ad systems now let advertisers pay only when a sale or lead occurs (Target CPA in Google Ads, Cost‑per‑Result goals in Meta’s Advantage+ campaigns, goal‑based bidding in Amazon DSP). With spending converted from sunk to variable, even low‑quality sellers can fund promotion from day‑one revenue.

- Light‑touch returns & the “Frequently Returned” tag

- Seamless returns cap consumer harm, but seller penalties are modest: a restocking fee, a metrics ding, or Amazon’s “Frequently Returned Item” badge—issued only after damage is done. Only the worst lemons are fully delisted, leaving plenty of mediocre goods in play.

- Ratings compression

- Star ratings on major platforms increasingly cluster between 4.3 and 4.9, leaving buyers little room to distinguish products. Part of this stems from review manipulation—Amazon blocked >250 million suspected fake reviews in 2023 alone, indicating the size of the problem.

- Heuristic‑driven shoppers

- Deprived of credible signals, buyers default to the price–quality heuristic—higher price means better goods (Monroe & Krishnan 1985). Sellers respond by listing identical inventory at staggered prices across multiple storefronts.

These frictions reinforce one another: CPA funding keeps every storefront bidding; fake reviews mask quality gaps; disposable brands dodge reputational blowback; and behavioural heuristics close the sale—locking the marketplace into what we call the grifter equilibrium.

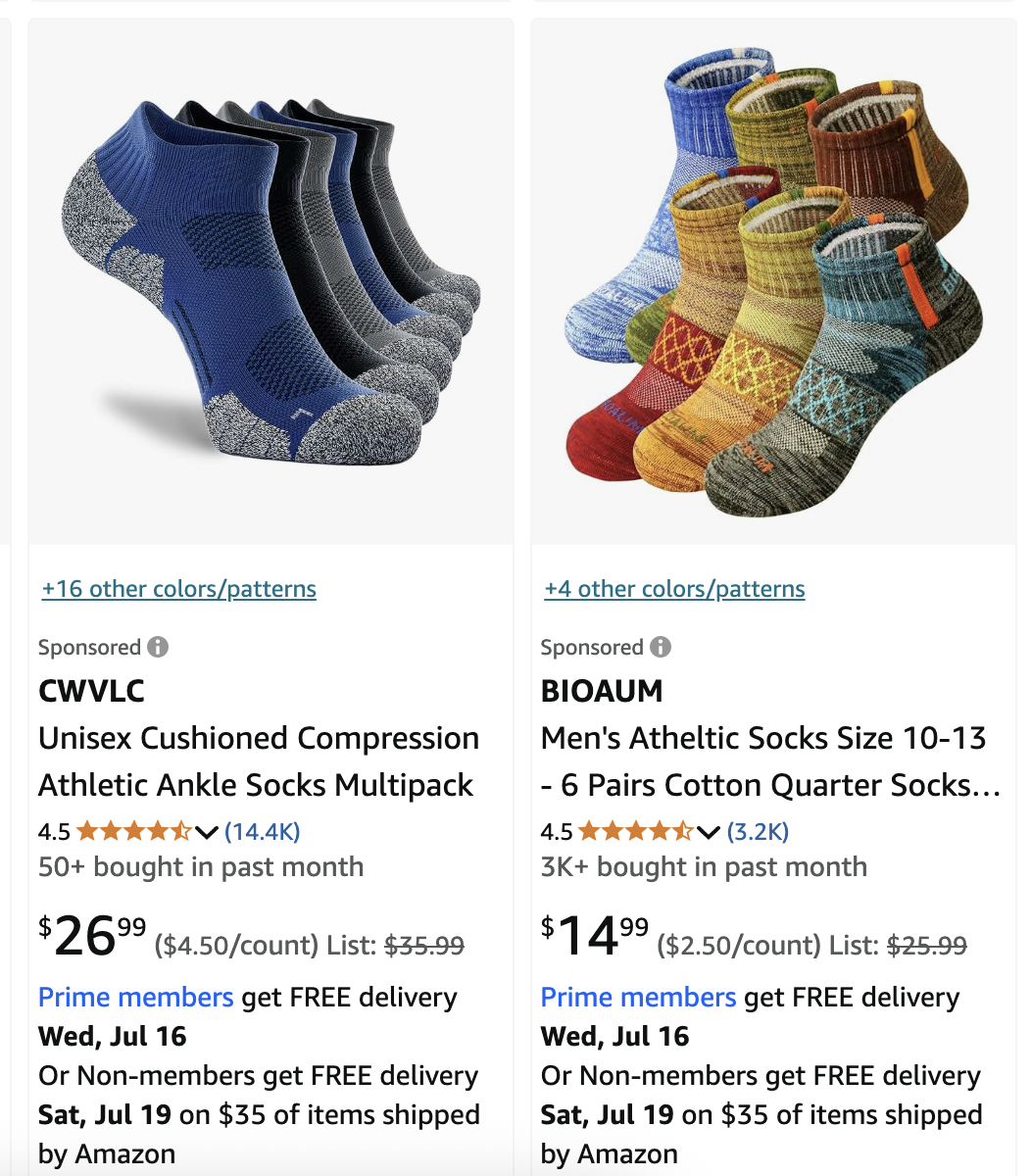

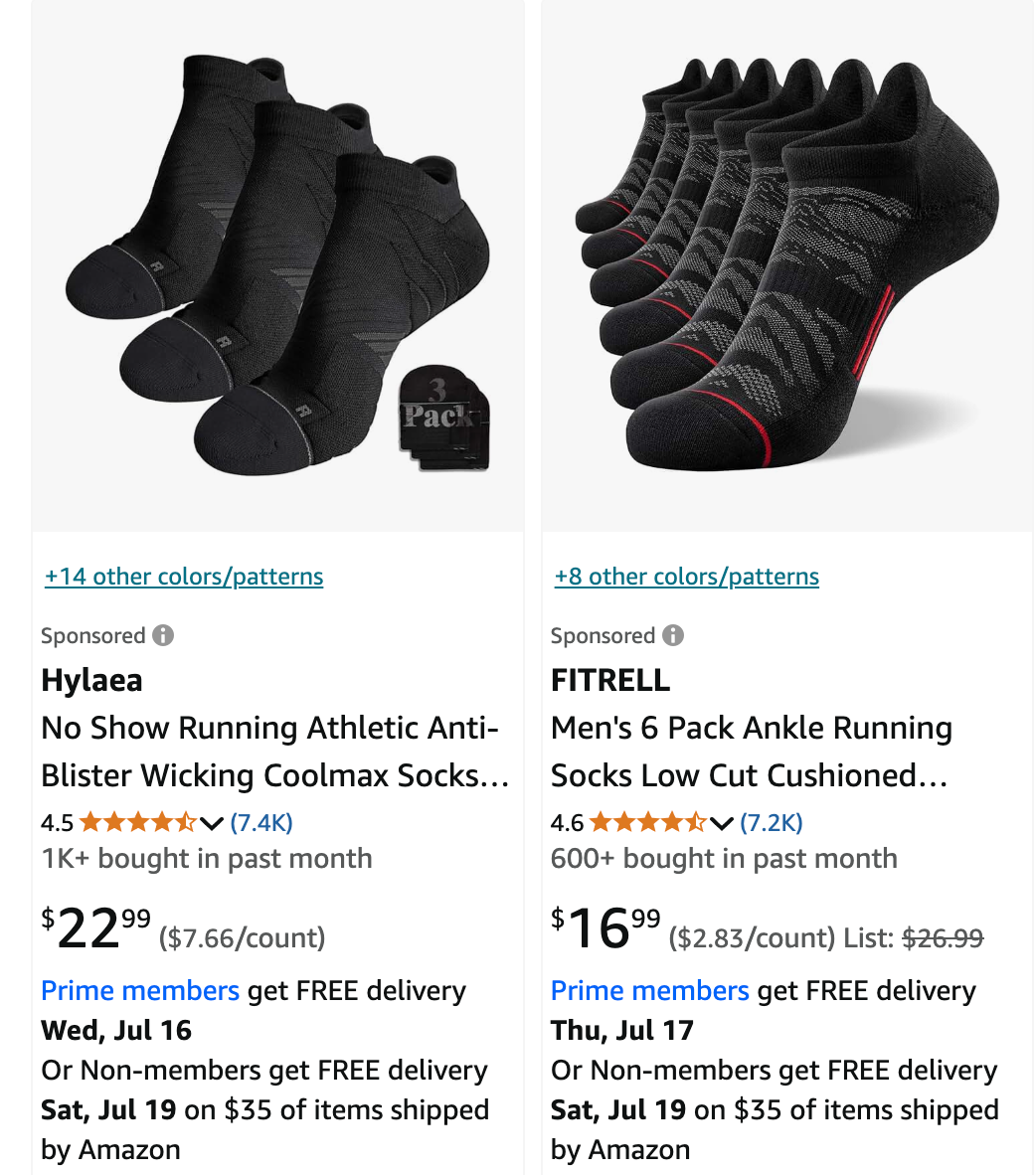

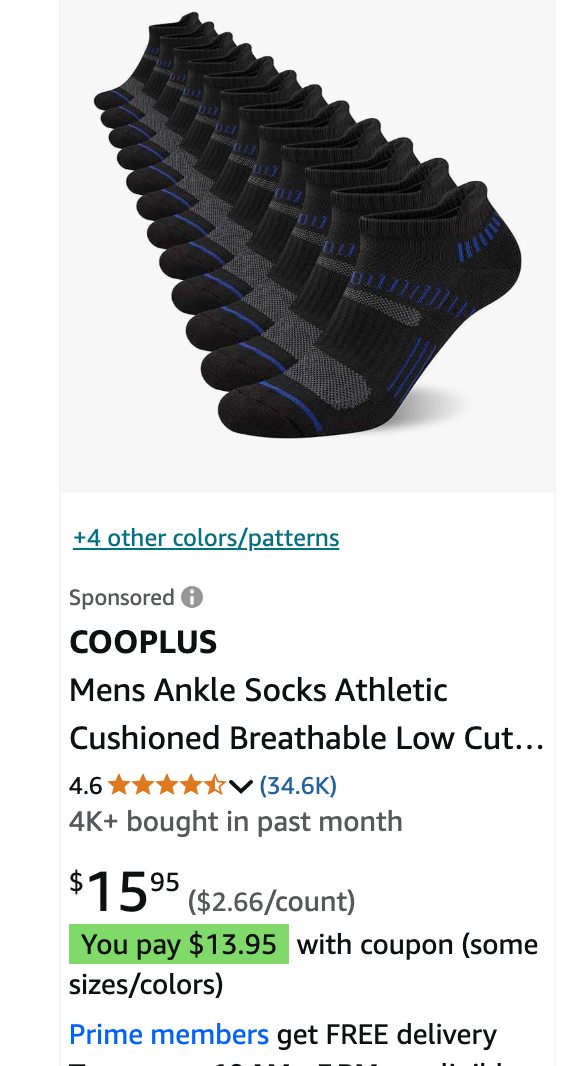

A Sock Search in Action

Search “ankle socks” on Amazon:

- Sponsored slots dominate; brands are unfamiliar.

- Ratings hover around 4.5; product photos are interchangeable.

- Prices span a wide range without visible changes in features.

Formalising the Grifter Equilibrium

A. Setup

| symbol | description |

|---|---|

| posted price (assumed equal across types) | |

| unit cost of high‐quality and low‐quality goods, with |

|

| platform take rate under cost‑per‑acquisition (CPA) bidding | |

| probability that a low‐quality sale triggers a penalty/return | |

| expected penalty per flagged lemon | |

| cost of opening a new storefront |

B. Per-Sale Profits

High- and low-quality sellers earn:

$$\pi_H = p(1-\tau) - m_H$$

$$\pi_L = p(1-\tau) - m_L - \phi(R + k)$$

Here, $\phi R$ is the expected per-sale penalty and $\phi k$ is the expected cost of relaunch amortized over the number of sales until detection (assuming detection occurs with probability $\phi$ per sale). High-quality sellers face no returns ($\phi = 0$) and no relaunch costs.

C. Participation Conditions

For both types to advertise, profits must be positive:

$$p(1-\tau) > m_H \quad \text{and} \quad p(1-\tau) > m_L + \phi(R + k)$$

Because $m_H > m_L$, the high-quality seller's threshold is more demanding. If $p(1-\tau)$ lies between these two thresholds, only low-quality sellers advertise—creating adverse selection rather than pooling.

D. Ad Signaling Fails Under CPA

Suppose both types satisfy the above inequalities. In a world without repeat-purchase advantages and with CPA bidding (where ad costs are variable), high- and low-quality sellers earn the same gross revenue per sale. Any difference in advertising expenditure would have to be sunk and unrecoverable.

If advertising is instead pay-per-sale, then low-quality sellers can fund their ads from first-period revenue. Consequently, advertising expenditure cannot credibly signal quality.

The model thus deliberately eliminates the mechanism by which high-quality sellers would otherwise advertise more (i.e., by having higher lifetime value).

E. Dynamic Relaunch

The expected present value of a low-quality storefront under CPA is:

$$\text{NPV}_L = \frac{\pi_L}{r + \phi} - \frac{\phi k}{r + \phi}$$

where $r$ is the discount rate. Solving yields:

$$\text{NPV}_L = \frac{p(1-\tau) - m_L - \phi(R + k)}{r + \phi}$$

A pooling equilibrium requires $\text{NPV}_L > 0$. Increasing $R$ or $k$ reduces $\text{NPV}_L$ and can break the incentive for low-quality sellers to persist.

Escape Hatches

Restoring signaling requires a cost that lemons cannot shirk:

- Persistent manufacturer IDs – reputation follows the factory, not the storefront.

- Return‑adjusted CPA surcharges – raise ($\tau$) when ($\phi R$) climbs.

- Escrowed ad bonds – forfeited if defect or return metrics exceed benchmarks.

- Relaunch detection – inventory‑fingerprint matching to raise ($k$).

The proposed remedies (persistent manufacturer IDs, return‑adjusted CPA surcharges, escrowed ad bonds, relaunch detection) aim to raise $R$ or $k$ in the above inequality so that low‑quality sellers’ net present value falls below zero. They do not restore the classic signalling equilibrium unless repeat‑purchase advantages are reinstated, but they can deter entry by the lowest‑quality sellers.

Why the Marketplace Doesn't Implode

- Return valve caps—but doesn’t erase—consumer pain.

- Generous return policies and Amazon’s “Frequently Returned Item” badge let buyers jettison the worst lemons. Hassle costs remain, but catastrophic disutility is rare.

- Ultra‑low unit costs keep lemons profitable.

- When socks cost $2 to make and the CPA take‑rate is 20 %, sellers can survive double‑digit return rates and still clear margin.

- Heterogeneous, often low‑stakes demand.

- For gym gear, kids’ camp supplies, or one‑off gadgets, shoppers accept higher quality uncertainty in exchange for speed and price, muting the penalty for mediocre goods.

- Platform revenue is tied to congestion—up to a point.

- Amazon collects a fee on every ad click and every sale, so a crowded, ad‑dense marketplace boosts short‑run revenue. The company does police egregious abuse to protect long‑run customer trust, but the optimal balance still tolerates a substantial volume of “good‑enough” products.

See also: https://www.gojiberries.io/optimally-suboptimal-behavioral-economic-product-features/

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0